History

History

Hot News

Hot News

- Academician Sergei Leonovich was invited to visit Qingdao Shamu Advanced Material Co., Ltd.

- In Memoriam of Ding Defu

- Congratulation 60 Years Old of Dudley J. Primeaux

- Pure polyurea is not afraid of testing , just like real gold is not afraid of fire

- The preparation of the second edition of spray polyurea elastomer technology has come to an end

- (2018)20th Spring QTG Pure Polyurea Technology Training Course at Jobste is Registering Now!

- 2017 Autumn QTG Pure Polyurea Training Course is Registering Now!

- 2017 Spring QTG Pure PolyureaTraining Course is Registering Now!

Experts

Experts

Prof. Weibo HuangGraduated from Sichuan University in 1986 andjoined MCRI (Marine Chemical Research Institute) the same year.

Mr. Dudley J. PrimeauxReceived an M.S. Degree in Organic Chemistry from Lamar University in Beaumont, Texas in 1984.

Raw material

Raw material

- Qtech-114 Aliphatic Polyurethane Top Coat

- Qtech-112 All Weather Surface Preparation System

- Qtech-404 Mining Equipment Ultra Anti-Abrasion Polyurea Material

- Qtech-400 High Speed Railway Sub Grade Polyurea Protective Coating

- Qtech-406 Elastomer Waterproofing Material

- Qtech-407 Anti-Microbial Polyurea Material

- Qtech-411 Bridge Ultra-Long Service Life Polyurea Material

Equipments

Equipments

Graco Settles 2nd Anti-Trust Case

[News from Paint and Coating Industry News, Tuesday, April 23, 2013]For the second time in less than a year, spray-equipment giant Graco Inc. has agreed to settle federal anti-trust claims related to a takeover of its competitor.

North America's largest spray foam and coatings equipment maker, Graco agreed Thursday (April 18) to settle a long-running federal antitrust case over the 2005 and 2008 acquisitions of, respectively, Gusmer and GlasCraft Inc.

The acquisitions gave Minneapolis-based Graco between 90 percent and 95 percent of the North American market for fast-set equipment, bringing higher prices and less competition to the industry, the Federal Trade Commission said in a statement .

'Monopoly Position'

"The acquisitions eliminated the only significant competition in the market, and resulted in Graco holding a monopoly position as the only full-line FSE manufacturer," the FTC said.

Furthermore, five years on, the statement said, the FTC's "investigation uncovered no evidence that Graco’s post-acquisition conduct provided any cognizable efficiency that would benefit consumers."

Normally in such cases, the FTC said, it would order "divestiture of the illegally acquired assets," but that is "difficult, if not impossible" in this case, because Graco has already absorbed or discontinued the Gusmer and GlasCraft brands.

Therefore, the consent order settling the allegations is designed to restore lost competition to the fast-set equipment market by opening up distributor agreements and other measures, according to the FTC.

Graco admits no wrongdoing under the settlement.

'Higher Prices, Diminished Choices'

The Gusmer and GlasCraft acquisitions "eliminated virtually all of its competition in the fast-set equipment market,” Richard Feinstein, director of the FTC’s Bureau of Competition, said in an announcement Thursday.

|

| Graco Inc. |

Graco's takeover of Gusmer and GlasCraft "eliminated virtually all of its competition in the fast-set equipment market," an FTC official said. |

“The clear result was higher prices and diminished choices for consumers.”

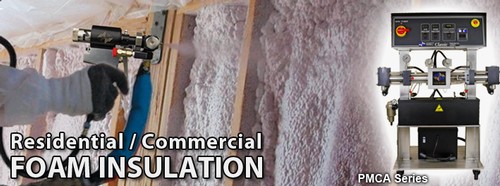

Contractors use fast-set equipment to apply polyurethane foam and polyurea coatings in commercial and residential buildings.

The company was not required to disclose the transactions at issue in the case under the Hart-Scott-Rodino reporting requirements.

Consent Agreement

The consent order requires Graco to halt any arrangement with distributors that precludes them from dealing with competitors, FTC said. It also prohibits Graco from “discriminating, coercing, threatening, or in any other way pressuring its distributors not to carry its competitors’ FSE products.”

Further, the order requires the company to license some of its technology to a competitor.

|

| Graco Inc. |

Graco said its foam equipment business covered by the FTC’s consent order accounts for less than five percent of the company’s overall business. |

The agreement, though final, will be subject to public comment until May 20, and the FTC will publish a description of the consent agreement package in the Federal Register thereafter.

Graco Statement

In a statement also released Thursday, Graco noted that the settlement was “non-monetary” and maintained that FTC’s complaint had factual and legal inaccuracies. The company also notes that it admits no wrongdoing under the settlement.

"While the company believes it would prevail in a court of law, its spray foam equipment business covered by the FTC’s decision and order accounted for less than 5 percent of the company’s consolidated net sales in the fourth quarter of fiscal year 2012," Graco's statement said.

"Consequently, management has concluded that a settlement enables Graco to put an end to the expense and distraction of protracted litigation with the FTC.

"The company believes that spray foam equipment contractors rely on innovative Graco technologies and products in this niche industry to rapidly evolve, enabling them to increase the share of spray foam insulation in the broader insulation industry. The company expects these vibrant dynamics to continue in the future."

Distributor Threats Alleged

Graco, which entered the fast-set equipment scene in 2002, sells the equipment almost exclusively to third-party distributors that act as middlemen between Graco and contractors.

About 550 distributors currently sell Graco FSE in the United States. Before the Gusmer and GlasCraft acquisitions, distributors generally carried products from multiple manufacturers, according to the FTC's complaint.

|

| PMC |

Under the settlement, PMC—a competitor formed by employees of the overtaken Gusmer company—will license Graco's technology. Graco had sued the fledgling company. |

After the acquisitions of its two biggest competitors, Graco “raised prices for the products, reduced product options, reduced innovation, and raised barriers to entry for firms seeking to compete with Graco, by taking steps to ensure that its distributors would distribute only Graco’s products,” the FTC said.

Specifically, the complaint says Graco threatened distributors “with termination or other retaliation” if they agreed to carry products from competing manufacturers, the FTC said.

Acquisitions, Lawsuit

Graco acquired Gusmer, of Lakewood, NJ, in 2005. Gusmer manufactured and sold a full line of fast-set equipment throughout North America and the world.

Two years later, former owners and employees of Gusmer, operating through PMC Garraf Maquinaria S.A., and Gama Machinery USA Inc. (now Polyurethane Machinery Corp., or PMC), sought to enter the market.

In 2008, Graco announced the acquisition of GlasCraft of Indianapolis, another FSE competitor in North America.

Meanwhile, Graco brought a federal lawsuit against PMC, alleging theft of trade secrets and breach of contract, among other things. The private lawsuit has been ongoing and has effectively prevented the company from competing in the marketplace, according to the FTC.

“The uncertainty of the outcome of the litigation has kept some distributors from purchasing fast-set equipment from Gama/PMC,” FTC noted in its complaint.

PMC also sued Graco , alleging that it “systematically raised the prices of spray foam equipment, while simultaneously attempting to inhibit PMC’s entry into the market by threatening distributors with retaliation if they choose to do business with PMC.”

|

| PMC |

The FTC order also includes settlement of years-old litigation between Graco and Polyurethane Machinery Corp. (PMC), of Lakewood, NJ. |

The new consent order incorporates a settlement between Graco and Polyurethane Machinery that requires Graco to license certain technology to the competitor.

Licensing Agreement

In a Feb. 8 letter to spray foam distributors , Polyurethane Machinery President Mike Kolibas says that a settlement in the case is “imminent” and invites future business.

“We have tentatively agreed to buy a license to certain intellectual property owned by Graco as a result of its acquisition of Gusmer and to dismiss our claims against Graco,” he wrote.

Koblias goes on to say that Graco has agreed to dismiss claims against his company and that distributors would be free to carry both lines of equipment following the settlement.

Koblias said Friday (April 19) that his company had nothing to add to the FTC's analysis and statements about the case.

ITW Anti-trust Complaint

The Gusmer/GlasCraft/PMC settlement with the FTC is unrelated to the agency's review of Graco's $650 million acquisition of Illinois Tool Works Inc. and ITW Finishing LLC.

Under that deal, announced in April 2011, Graco would have swallowed its biggest competitor.

In December 2011, however, federal antitrust regulators challenged the takeover in an administrative complaint and federal-court action.

Three months later, the deal appeared back on track , but on June 1, 2012, the FTC changed course and ordered Graco to sell off ITW's liquid finishing businesses to settle the antitrust allegations.

That divestment was to have been completed within six months, but an FTC spokesman said Monday (April 22) that the order still had not been finalized. The 180-day divestment clock won't start until the order is finalized. Graco's statement also referred to the FTC's review of the ITW case as "ongoing."

Graco is a manufacturer of systems and equipment that move, measure, control, dispense and spray fluid materials. The company serves industrial and commercial customers. The company’s products for coatings and foam application include proportioners, spray guns, transfer pumps, and accessories.